Introduction

If hydrogen is colorless, why does everyone call it blue or green? The color tags have become a common part of energy conversations because they help explain how hydrogen is produced and its environmental impact. Many countries now include hydrogen in their plans to cut emissions, lower fuel imports, and support new clean energy systems for industry, transport, and daily use.

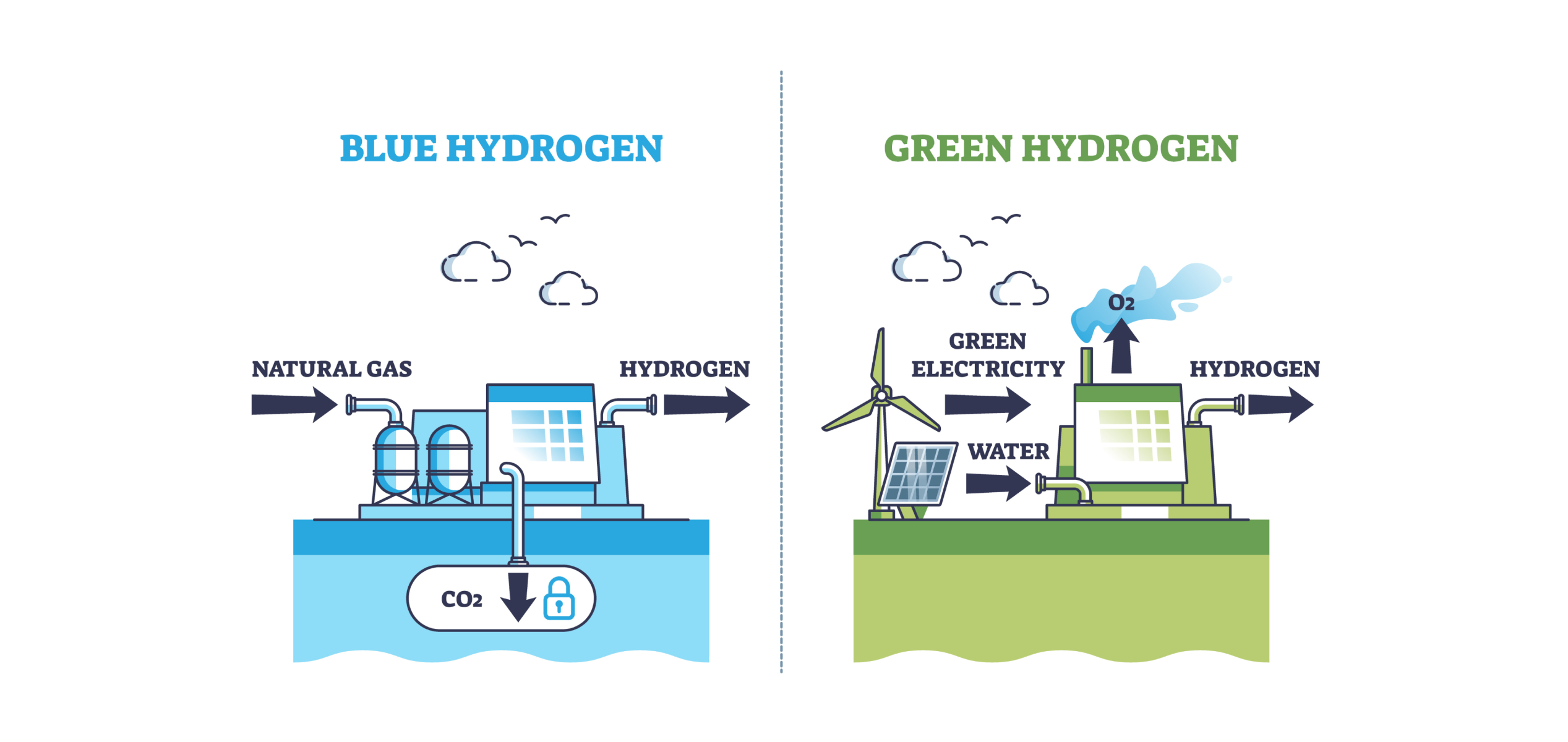

But what do these colors really mean, and why has the world started using them? Blue hydrogen is produced from natural gas with systems that try to manage the carbon released along the way. Green hydrogen comes from renewable electricity that splits water into hydrogen and oxygen. Both target lower emissions, but they rely on different inputs and create different outcomes. This blog will simplify these differences and help you understand what each option means for the future of clean energy.

What is blue and green hydrogen?

Blue hydrogen is produced from natural gas (usually methane) via processes such as steam methane reforming (SMR) or autothermal reforming (ATR). The carbon dioxide (CO₂) released in the process is then captured and either stored underground or reused using carbon capture and storage (CCS) or carbon capture and utilization (CCU) technologies. If the CO₂ capture works well and methane leaks are controlled, blue hydrogen can be a lower-carbon alternative to traditional fossil-based hydrogen choices.

Green hydrogen

Green hydrogen is produced by splitting water (H₂O) into hydrogen (H₂) and oxygen (O₂) using electricity from renewable sources, such as solar or wind power. In India, as per the Ministry of New and Renewable Energy (MNRE), hydrogen is considered “green” only if emissions during production remain below 2 kg of CO₂ equivalent per kilogram of hydrogen (≤ 2 kgCO₂eq/kg H₂). The Indian government has also introduced a framework of checks and balances to ensure that only hydrogen meeting this standard can be officially certified as green under the Green Hydrogen Certification Scheme.

Blue and green hydrogen is essential for the future of clean energy

What is the difference between blue hydrogen and green hydrogen?

The difference between blue and green hydrogen translates into how they’re made, what they cost, and what trade-offs they bring. Here’s how

| Aspect | Green hydrogen | Blue hydrogen |

|---|---|---|

| Method of production | Green hydrogen is made by splitting water using electricity that comes from renewable sources like solar or wind. | Blue hydrogen is produced from natural gas (SMR or ATR). The gas is broken down, and the carbon released is captured and stored or reused. |

| Carbon emissions during the production process | Green hydrogen has very low emissions. To be considered green hydrogen, it must emit no more than 2 kg of CO₂ for every kilogram of hydrogen produced. | Emissions are significantly lower than untreated fossil hydrogen, but some CO₂ may still escape depending on CCS/CCU efficiency and methane leakage. |

| Impact on the environment | Green hydrogen can achieve very low lifecycle emissions when produced using renewable electricity and when it meets India’s MNRE threshold of ≤ 2 kg CO₂e per kg H₂ | Lower than grey hydrogen, but lifecycle emissions depend heavily on CO₂ capture efficiency and methane emissions. |

| Cost | Green hydrogen generally has a higher cost today compared to fossil-based hydrogen, but its exact price varies widely depending on renewable electricity tariffs, electrolyser costs, and plant scale. | Blue hydrogen can be cost-competitive under favorable natural-gas prices and efficient CCS, but its cost advantage is not universal and depends heavily on gas price volatility and carbon-capture costs |

| Water usage | Electrolysis requires about 9-10 liters of pure water per kg of hydrogen, but the total water requirement, including purification and cooling, is typically higher (often 17–22 litres per kg). More efficient than fossil-based hydrogen. | Blue hydrogen often uses more water due to the natural gas reforming process and carbon capture systems, both of which add to water consumption. |

| Base (Resource used to create) | Renewable energy and water are both widely available in India. | Blue hydrogen relies on natural gas, which is finite and subject to international price movements and supply risks. This creates long-term uncertainties. |

| Scalability and infrastructure | It depends on renewable energy capacity, electrolyzer manufacturing, and new infrastructure. India’s target under the National Green Hydrogen Mission (NGHM) is to add about 125 GW of dedicated renewable capacity by 2030. | Blue hydrogen can expand more quickly in the near term, as industries can continue using existing natural gas pipelines and facilities. This makes it easier to adopt in the short run, even if it does not fully solve the fossil dependency issue. |

| Strategic fit for India’s sustainability goals | Green hydrogen aligns well with India’s ambition to cut emissions, reduce import dependence, and build a competitive export market in the future. | Blue hydrogen can act as a transitional option only if methane leakage is tightly controlled and CO₂ capture rates are high; otherwise, the emissions benefit may be reduced. It helps industries begin lowering emissions today, even if it does not eliminate the need for fossil fuels. |

Green hydrogen is cleaner and uses renewable energy, making it better for India’s long-term plans. Blue hydrogen is cheaper today and easier to start with because it uses existing natural gas systems.

Bottomline

Hydrogen will not solve every energy challenge, but it has become a serious contender in India’s plans to cut emissions and secure long-term energy supply. Blue hydrogen gives industries a practical way to begin reducing carbon while existing infrastructure continues to play a role. Green hydrogen sets the direction for where the sector is eventually headed, powered by renewables and cleaner production limits. The two are not rivals. They are steps on the same path, each useful at a different stage of the transition. The real work now lies in choosing where to apply each approach and building the capacity to make those choices count.

Frequently asked questions

The frequently asked questions section is a reliable source for unlocking answers to some of the most crucial inquiries. Please refer to this section for any queries you may have.

- FAQ

No. Blue hydrogen reduces emissions but is not completely carbon-free. It is made from natural gas or coal, like grey hydrogen, but with carbon capture technology to trap the CO₂. This makes it a lower-carbon option, but it still involves fossil fuels and requires energy (which can cause more CO₂). Only green hydrogen (from renewables) is truly emissions-free in production.

The National Green Hydrogen Mission was launched by India’s government on 4 January 2023, with an outlay of ₹19,744 crore. Some of the important targets of this mission are -

1. Green hydrogen production capacity - At least 5 million metric tonnes (MMT) per year.

2. Renewable energy capacity addition - About 125 gigawatts (GW) of new renewable energy capacity.

3. Total investments - Over ₹8 lakh crore in the green hydrogen ecosystem.

4. Employment creation - Over 6 lakh jobs in this sector.

5. Reduction in fossil fuel imports - Over ₹ 1 lakh crore.

6. Greenhouse gas emissions reduction - Avoidance of nearly 50 million metric tonnes (MMT) of CO₂ emissions annually.

Green hydrogen can decarbonize hard-to-clean sectors like transportation and industry -

1. Steel production/iron & steel industry - Green hydrogen can replace coal (or natural-gas derived hydrogen) in processes like direct-reduced iron (DRI), enabling low-carbon (“green”) steel.

2. Fertilizer/ammonia production - Hydrogen is a core feedstock in ammonia (and thus fertilizer) manufacturing. Green hydrogen can substitute “grey” hydrogen (currently largely from natural gas), significantly cut carbon emissions, and reduce dependence on imported fuels.

3. Oil refining/petrochemicals/chemical industry - Refineries and petrochemical plants typically use hydrogen for processes like desulphurization, hydrocracking, and other refining steps. Replacing conventional hydrogen (or fossil-fuel-derived feedstocks) with green hydrogen helps cut emissions.

4. Transport: (Heavy-duty transport, shipping, maritime, heavy industry) - Green hydrogen (or derivatives) can be used as fuel for sectors that are hard to electrify. E.g., heavy trucks, ships, aviation, or long-haul transport.

5. Chemical processing / broader industrial processes - Beyond steel and fertilizer, green hydrogen can serve as a clean energy carrier or feedstock in chemical manufacturing, high-temperature industrial processes, and energy-intensive industries where electrification alone isn’t enough.

6. Energy security and import independence - By producing hydrogen domestically using renewable power, India can reduce reliance on imported fossil fuels and feedstocks (like natural gas), boosting energy security while lowering carbon emissions

Grey hydrogen is the common kind made today from fossil fuels without any carbon capture. It comes from steam reforming natural gas or gasifying coal, and its CO₂ is simply released into the air. This makes grey hydrogen very carbon-intensive. Blue hydrogen adds CCS to this process, while green hydrogen uses renewable power instead.

India aims to produce about 5 million metric tonnes of green hydrogen annually by 2030 under the National Green Hydrogen Mission. But total hydrogen demand across industries like fertilizer, refining, chemicals, and energy is expected to be around 15–20 MMTPA by 2030. India’s planned 5 MMT of green hydrogen by 2030 may meet only a portion of the projected 15–20 MMT total hydrogen demand, depending on sector-wise adoption and actual demand growth. That means other fuels or hydrogen types will still be needed for many years.

Hydrogen’s low volumetric energy density requires high-pressure compression, liquefaction, or conversion to carriers such as ammonia or methanol, all of which need specialized infrastructure. Building such infrastructure at scale is expensive and complex. This remains one of the main hurdles for hydrogen adoption in India and worldwide.

Yes. Producing green hydrogen by electrolysis requires water. In water-stressed zones of India, ensuring enough high-quality water supply for large hydrogen plants can be difficult. Some reports note this as a key challenge for scaling green hydrogen under the National Green Hydrogen Mission.

Yes. Hydrogen can substitute fossil-fuel-based inputs in hard-to-decarbonize industries such as steel, fertilizer, or chemical manufacturing. Using low-carbon hydrogen instead of coal or fossil hydrogen helps reduce emissions in these sectors. Reports on India’s hydrogen potential highlight this as one of the biggest uses.

Sources

Global Hydrogen Review 2025 Demand

The Key Differences Between Green Hydrogen and Blue Hydrogen

On the cost competitiveness of blue and green hydrogen

The importance of the colours of hydrogen

India announces definition of Green Hydrogen

Pralhad Joshi launches Green Hydrogen Certification scheme

Centre launches Green Hydrogen Certification Scheme of India (GHCI)

Green Hydrogen Standard for India

Natural gas remains the largest source of hydrogen in our long-term projections

Keep reading...

View all